In October 2020, less than two months away from implementing the Tarea Ordenamiento (economic reforms), Cuban president Miguel Diaz-Canel took to the podium to assure every Cuban that their saving accounts – whether they were in Cuban pesos (CUP), Cuban convertible pesos (CUC) or the magnetic (MLC) – were protected.

The Government granted citizens a grace period of at least six months, from January 1, 2021, to change their CUC into Cuban pesos. However, when so-called “Day Zero” rolled around, billing and payment accounts of the self-employed, individual farmers, and other private management methods, which receive bonuses in CUC, and accounts of healthcare professionals working missions abroad, were automatically changed into CUP. A movement that was carried out using the 24:1 exchange rate.

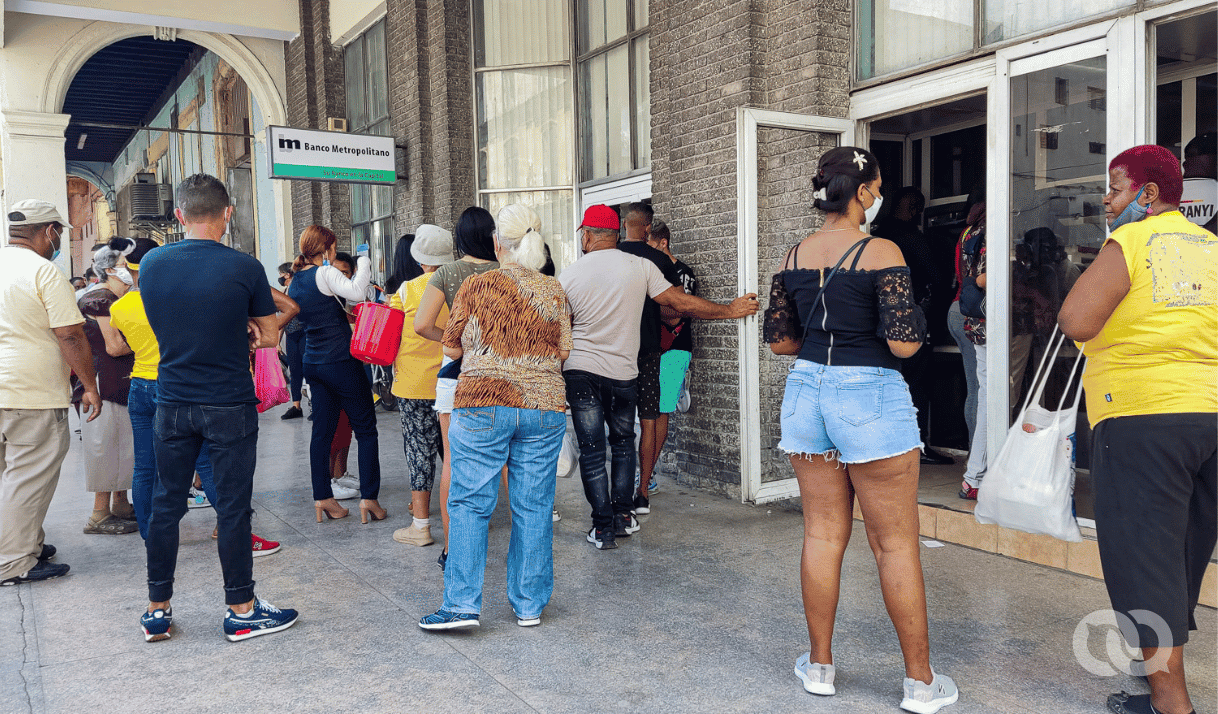

“Nobody has to be worried (…) including our medical collaborators abroad,” Diaz Canel assured us. Meanwhile Marino Murillo Jorge, Chairman of the Permanent Commission for Implementation and Development of the Economic and Social Policy Guidelines, reinforced, on a telecast of Mesa Redonda, that Cubans didn’t need “to run to the bank” afraid their bank accounts will be affected.

Yet reality on the island has been completely different ever since, despite these declarations.

Inflation of products and services that went hand-in-hand with the process known as “Currency Unification” has had a very negative impact on the Cuban people’s savings. Ever since then, access to food, clothing and basic essentials – conditioned by inflation – has become even more limited. Contrary to the Government’s declarations, Cubans’ assets have been compromised. A reality the Cuban Government can’t hide.

“Technically-speaking, in a scenario of inflation, saving accounts in pesos lose their purchasing power. You can’t think that we’re going to take these savings and multiply them by three, or four, for them not to lose their purchasing power. But we have to make other analyses, not everything is linear,” Murillo said on October 14, 2020.

Sums that don’t add up

The negative effect on savings accounts and their purchasing power sparked unease and concern among the Cuban population. Some healthcare professionals, members of the Henry Reeve International Medical Brigade expressed their nonconformity in the comments section of article published by Cubadebate with the headline: “Currency unification and exchange rates in Cuba: What will happen to saving accounts?”

“It’s hard to imagine that my savings over many years will be devalued three or four or however many times. It’s even harder to imagine this knowing that our services are paid for in USD. At least this percentage we receive, out of the total paid to the government for our services, should be deposited into our accounts in USD. This is the only way we can come out of this process more or less OK. Our money is frozen and we can’t manage our accounts, which puts us at a disadvantage,” a user identifying as Roy stated.

“I endorse the proposal that the accounts of healthcare professionals on missions abroad should be converted into MLC (the magnetic dollar), as I believe this is fair, balanced and just. I support the proposal for the following reasons: wages from medical missions abroad are in MLC; every account of a healthcare professional working on a mission works with a debit card, so USD don’t need to circulate, and it isn’t any different to how Cubans use money to buy at MLC stores; this is society’s way of recognizing those who have been and are displaying so much altruism, solidarity and integrity,” a second professional using the name “Cardenas” pointed out.

According to economist Miguel Alejandro Hayes, keeping exchange rates the same at the same time as increasing prices, took away the government’s “excuse” for the exchange rate, generally-speaking.

“If the economy’s price level quadruples and the exchange rate remains the same, savings lose four times their purchasing power,” he pointed out.

According to Hayes, the Government could have prevented this situation by multiplying people’s savings, at least for accounts in Cuban pesos.

The reality is that over the course of 2021, currency reform and inflation liquefied the purchasing power of savings accounts, both in CUP as well as CUC.

“CUC accounts were changed into CUP accounts using the 24:1 exchange rate and not the 1:1 exchange rate, but that didn’t guarantee they would keep their value,” economist and professor Pavel Vidal indicated, who believes that the process “is disastrous for credibility in the banking system and national currency.”

Vidal lays out different reasons why the real value savings accounts had to buy goods and services was “annihilated”. These include, prices going up – more than once-; the exchange rate that came to dominate household finances wasn’t the 24:1 rate, but 120:1 rate at CADECAS (bureaus de change) and banks and nearly 180:1 on the street. Another factor was the fact that bank interest rates didn’t increase. The latter means savings were lost because money was kept in the bank, which is technically known as a “negative interest rate”.

In order to stop clients from going to bank branches to get back their assets, the Cuban Central Bank (BCC) issued an order stipulating that if the account holder didn’t appear to close their time deposit account within six months, an additional bonus of 1.5%-3.5% would be added in interest. However, this measure wasn’t enough.

Cuban doctors are one of the country’s greatest sources of foreign currency. According to Cuba’s Office of Statistics and Information (ONEI), service exports of medical professionals generated approximately 6.4 billion USD in revenue, in 2018. While this figure dropped to approximately 4 billion in 2020, it still accounted for 80% of the country’s total exports. Meanwhile, 75% of these professionals’ wages end up in the State’s coffers. Doctors, nurses, technicians and other healthcare professionals only end up keeping a low percentage of their wages.

Precarious working conditions of Cuban doctors abroad, as well as the measly compensation they receive, has been the subject of multiple complaints made before the UN Human Rights Council. It has even been classified as “modern slavery”, in a 12-page report presented in Geneva by the NGO Prisoners Defenders, on November 6th 2019. The document, which includes 450 cases of healthcare professionals, mentions threats, movement restrictions, labor exploitation, compulsory subjugation and other human rights violations committed by the Cuban Government.

Nevertheless, as other people pointed out in the Cubadebate article, concerns about saving accounts in Cuba went beyond those working abroad and touched other sectors.

“Haven’t the rest of us also been saving or aren’t we also Cubans? It’s really sad for a pensioner to have saved for years and then their savings lose 10 or 20 times their value in a day. It’s true, wages will go up in proportion to prices, but my savings will also drop in proportion,” a user wrote under the name Oscar in the comments section.

The same thing happened to Jesus Lopez, who had 1000 CUC saved in the bank, a sum that he had managed to put away over many years of hard work. Back then, he’d wanted to buy a TV and a fridge/freezer. A goal he was never able to achieve after his CUC account was changed into foreign currency certificates, which he could only withdraw when the country had enough liquid funds, he told elTOQUE. It’s been two years since then.

“You can cash in these certificates if you want Cuban pesos at the 1:24 exchange rate, which is nothing now with the hyperinflation,” Jesus explains. “Before the Tarea Ordenamiento, a peso account with a 7% interest rate could get you 1000 pesos per month in six years, depending on the amount you deposit. With a monthly wage or pension of 450 pesos, it would be double. Now, those 1000 pesos are worth nothing.”

According to Jesus, the bank system has lost all credibility among the population because “there aren’t any future plans” and the Government hasn’t made a pronouncement about converting these foreign currency certificates into MLC.

Cuban reality post-CUC

The CUC began to circulate in Cuba in 1994 and it co-existed alongside the CUP and US dollar, giving rise to a complicated economic reality. Two exchange rates were established within this framework. One destined for the population, at 24 CUP for 1 CUC. While the second rate was only to be used in the business sector, where 1 USD was the equivalent of 1 CUP/CUC? Up until 2004, they tried to ensure there was one dollar to back up every Convertible peso in circulation. But this practice wasn’t upheld over time and the CUC became an over issued currency over the years.

This was the case until November 24, 2020, when a Decree-Law was announced in the Cuban Republic’s Official Gazette. This law stipulated that the Convertible Peso would be removed from circulation. The CUC stopped officially circulating on January 1, 2021, and this began the currency and exchange rate unification process; two of the Tarea Ordenamiento’s four fundamental pillars, along with the gradual elimination of excessive subsidies and wage reform.

According to Diaz-Canel’s own words in December 2020, the Tarea Ordenamiento would give the country “better conditions to carry out the changes needed to update our economic and social model, on the basis of ensuring every Cuban has greater opportunities, rights and social justice.”

This was a strategy the Cuban Government had been cooking up for a good while. The Cuban Communist Party’s Economic and Social Policy Guidelines – approved in 2011 – mention the need to move towards currency unification, “bearing in mind work productivity and the efficiency of distribution and redistribution mechanisms.”

“This process will require rigorous planning and execution, both on an objective and subjective level, because it is so complex,” the document reads.

Meanwhile, the Central Bank of Cuba announced that people “with saving accounts, time deposits and deposit certificates” in CUC would be able to decide – within a maximum timeframe of 180 days – whether they want to convert their balance, in its entirety or a partial amount, into Cuban pesos or another international currency such as dollars or euros. Nevertheless, the account holder won’t have the chance to increase their balance or withdraw cash in these currencies. Conditions that could change if the country has access to foreign currency. If, however, the user decides to withdraw their funds, they will receive the equivalent in CUP, with interest, at the exchange rate that day.

Once this timeframe ends, accounts that are still in CUC will automatically be converted into CUP at the 1:24 exchange rate, generating interests in this currency.

The Cuban peso, a devalued currency

The Cuban President, in one of his speeches, pointed out that the Tarea Ordenamiento reforms wouldn’t be risk-free. “One of the main risks is that inflation above the planned rate will occur, which will be made worse by current shortages,” he ruled.

At that time, experts had predicted that the Cuban Government’s new economic policies – including wage reform – wouldn’t be enough to tackle higher prices of basic services and a lot of consumer goods, if inflation wasn’t kept in check. That’s exactly what happened. In late August 2022, less than a year after the economic reforms process began, US economist Steve Hanke estimated that the island ranked second place in the world in terms of the highest inflation rates – which stood at 135% per year – with a devaluation of 68.35% against the dollar.

In October that same year, the illicit market of foreign currency indicated a dizzying devaluation of the Cuban peso (CUP). For the first time since the 1990s, the currency reached an exchange rate of 150 CUP : 1 U.S. dollar on the informal market. According to Vidal, this was also the result of consequences of the COVID-19 pandemic – a drop in tourism and less dollars in circulation – and sanctions by former US president Donald Trump’s Administration.

Official statistics – calculated using the Consumer Price Index – pointed out inflation of 70% in 2021 and 39% in 2022. A scenario that has gone hand-in-hand with an incredible spike in food and drink prices of 63%.

These calculations underestimate real inflation because they are based on 2010 prices, Vidal says:

“If you apply this same underestimation to current numbers, we would see that real inflation was more than 200% in 2022, which is one of the highest inflation rates in the world.”

Cuba’s current crisis is worse than that of the 1990s Special Period crisis. Inflation has stripped wages, pensions and savings of Cuban families of any real value. At the same time, it has exacerbated inequality, and added uncertainty and a lack of confidence in the future of our economy.

This article was translated into English from the original in Spanish.

Comments

We moderate comments on this site. If you want to know more details, read our Privacy Policy

Your email address will not be published. Mandatory fields are marked with *